Selling Power's 500 Largest Sales Forces in America in 2024

For the past 26 years, Selling Power magazine’s research team has ranked companies according to the estimated number of salespeople they employ. The 500 top companies in America on Selling Power’s 2024 list employ the world’s largest sales forces and depend on millions of salespeople to achieve their revenue goals. This year, the number of salespeople in these companies totals more than 23 million.

This year’s data was collected during the current inflationary period of higher interest rates but positive employment numbers – although those numbers have subsequently been revised downwards, and our findings also do not paint such a rosy employment picture. While transportation and travel industries continued their rebound, the tech sector saw a leveling off while overall manufacturing experienced worrisome declines.

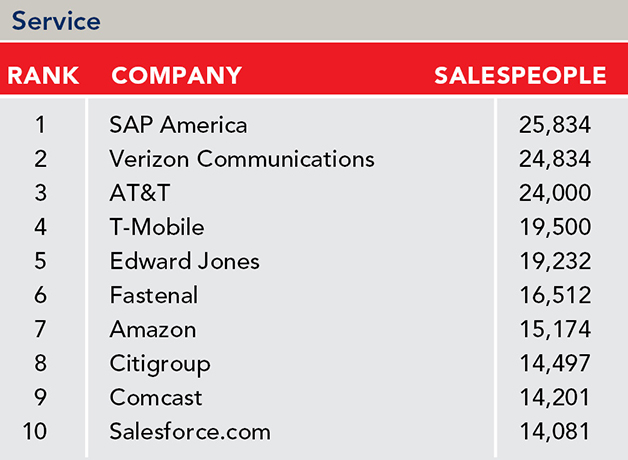

See the Top 10 Largest Sales Forces in each industry:

THIS YEAR’S OVERVIEW

The 2024 Selling Power 500 Largest Sales Forces in America list includes the top 200 companies in the manufacturing industry, the top 200 companies in the service industry, the top 50 insurance companies, the 30 largest direct-selling companies, and the top 20 automotive-dealer organizations (megadealers). Every year, new companies make the list while others drop off.

The total number of salespeople reported by all 500 companies on this year’s list is 23,285,353, which represents a disappointing decrease of almost 10%, due largely to a shift in the direct selling industry. This is unsurprising given the nation’s inflationary belt-tightening, which contributed to a decreased viability in making a living wage in direct selling. But direct selling does not account for the entire decline, as the manufacturing, service, and insurance industries all experienced a decrease in the number of salespeople.

The aforementioned direct selling category, which had shown a brief surge immediately following the end of the pandemic in terms of sales force growth, reported a large overall decrease in the number of salespeople from 2023 to 2024.

In other categories:

- The number of salespeople in the manufacturing industry decreased by more than 10% – the fourth consecutive year with a significant decline.

- The number of salespeople in the service industry (which had been holding steady) experienced a decrease of more than 7%.

- The insurance industry posted a third consecutive decrease in the number of salespeople – declining by about 1%.

- Even in a hot automotive industry, the reported number of salespeople increased only 3.72%.

Overall, without the direct-selling numbers, the number of salespeople decreased by more than 90,000. One could question whether the proliferation of generative AI is beginning to negatively impact sales organization staffing, or whether the impact is from inflationary pressures or a combination of technology and economy.

The states with the most Selling Power 500 companies are California (56), New York (49), and Texas (39). The states in which the Selling Power 500 companies employ the largest number of salespeople are also New York (6,595,252), California (4,402,720), and Texas (3,671,917). These states account for about 29% of the total companies and a whopping 63% of the total salespeople. It is interesting to note that California and New York continue to remain stagnant in companies with major sales forces while states like Texas are gaining and have made it into the top three for the second consecutive year in both the number of companies on the Selling Power 500 list and for the total number of estimated salespeople employed.

For the second year, we are also tracking the gender gap in the leadership of these major companies. It is highly disappointing that, in 2024, a paltry 10% of the Selling Power 500 companies are led by women – and worse, there were no gains from 2023. In the companies we are reporting on that lead the tech sector, all are helmed by men, with the notable exception of Oracle’s CEO Safra A. Catz.

PRODUCTIVITY RIDES HIGHER ON AI ADOPTION

Continuing a trend in the numbers of the previous three years, our research team found that salespeople employed by manufacturing industry firms contributed a higher amount of sales revenue than those in any other industry. The top 200 manufacturing firms employ 439,537 salespeople and produce just over $6.1 trillion in sales. That’s an average of $14 million in sales per salesperson. This represents a significant (11.7%) increase in productivity compared to the previous year and continues in tandem with a declining overall manufacturing sales force. While the number of manufacturing salespeople dropped by more than 10% from last year, the number of manufacturing employees declined by only 1% when compared with last year.

The top 200 companies in the service sector reported a sizable decrease of over 43,000 salespeople, bringing the total to 557,115 salespeople. Even with the significant decrease in salespeople, the total revenue for the sector topped $7.1 trillion – an increase of 8% since last year. This represents more than $12.7 million in sales per salesperson and a sizable 16.49% increase in productivity – now showing 10 straight years of productivity gains. The number of service-sector employees posted an increase of 2.2% this year, making it six consecutive years of reported employee growth, although the rate of growth has been declining.

The top 20 automotive megadealers reported uniformly positive results this year. The top 20 firms own 2,201 dealerships, employ an estimated 33,015 salespeople, and produce over $194 billion in sales (up just over 5%). This brings the average annual sales per salesperson to almost $5.9 million (up by 1.3%).

The top 50 insurance companies employ sales forces totaling 557,256 across the industry, with an average sales volume per salesperson of $3,136,372. This represents a 6.96% increase in productivity. The number of salespeople remained relatively unchanged from last year (a 0.05% decrease), which factored into the productivity numbers. The number of employees increased by less than 2% over last year, a significant drop in the rate of employee growth.

The top 30 direct-selling companies reported a sizable decrease in total salespeople, coming in at just under 22 million for 2024.

Here are some of the key takeaways for this year:

- The total number of salespeople across the major industries declined for a second straight year, despite increasing revenues. This is indicative of the continuing economic uncertainty, mixed with the technological gains from the implementation of AI within sales organizations.

- Many of the major tech companies continue to shed employees, continuing a post-pandemic trend.

- Overall, revenue increased significantly across all industries, continuing to show inflationary pressures and rising prices.

- Women-led Selling Power 500 companies account for only 10% of the total companies on this year’s listing, which was the same percentage as last year.

- The number of companies based in California and New York reported on in the Selling Power 500 remained stagnant in 2024, while states like Texas continued to gain companies.

- As inflation continues to defy best efforts to tame it, and the Fed contemplates interest rate cuts for the remainder of 2024 and into 2025, the economic ramifications for the Selling Power 500 companies will continue to evolve.

SELLING POWER 500 SALESPEOPLE DRIVE THE ECONOMY

Each salesperson in the service or manufacturing industry supports, on average, 24.71 other jobs within their respective companies. That figure marks a significant increase from last year’s number of 22.26 and indicates the importance of the sales force, even when it has declined in numbers. These companies employ a total sales force of almost one million, who produce over $13.2 trillion in sales and ensure the employment of over 25 million people. This underscores the argument that the sales forces of America hold the keys to success for their companies and their fellow employees.

HOW TO GET THE MOST OUT OF THE SELLING POWER 500

Top executives – Use the Selling Power 500 to benchmark your company’s productivity per salesperson. Find out how you measure up to your competition and the average in your industry. Check which companies have decreased their sales forces and which are gearing up for expansion.

Salespeople – Use the Selling Power 500 as your best-prospect list. There is no other source that gives you access to those companies that purchase products for a large number of salespeople. This is your ideal list if you sell sales training, sales-incentive services, customer relationship management solutions, automotive fleets, sales meetings, or trade show services. Begin your account planning by researching company Websites.

Job seekers – Use the Selling Power 500 to plan your sales career. These 500 companies employ the largest sales forces in America. Large companies invest heavily in recruiting, training, and rewarding sales staff. To find job openings, log onto the companies’ Websites. Our Finding the Right Organization for Your B2B Sales Career is also a useful tool when seeking B2B sales positions.

Educators – Use the Selling Power 500 as a tool to build next year’s curriculum. Every year, Selling Power 500 companies seek to recruit more than 500,000 college graduates. There are more than a dozen colleges that offer sales curricula, and all of their graduates can look forward to solid careers in sales. Prepare your future students for a lucrative career in sales. (Note: Media research shows that the average Selling Power magazine reader has a college degree, works in sales management, and has a household income of over $174,000 per year.)

Special thanks go to our corporate research team for collecting the data. To have your company listed in the Selling Power 500 next year, please email research@sellingpower.com.

Automotive Dealers

Automotive Makers

Direct Sales

Insurance

Manufacturing

Service